The inspiration for this blog comes from Randy and Jana Hubbs of Global Summit Management. They made a great point about how gold has retained its value over the years — even thousands of years, and what this tells us about the true effect of inflation on our money.

10,000 years ago a Spartan soldier could buy a shield and a pretty nice suit of armor with an ounce of gold. Today, a businessman could buy a briefcase and tailored suit for the same amount.

Gold is a commodity which has held its value over thousands of years. Currency, on the other hand, has not. Currency is not tied to anything fixed (the way gold is), and thus, the government can just print more at their own free will.

When there is more of a product in the market, it loses value.

Inflation and Your Money

Inflation happens when the government prints more money. And, why would they want to do that? The government loves inflation because they know the future value of new dollars will be less.

For people like you and I who have done all the “right things” by saving and investing our money into traditional retirement plans and 401k’s, inflation robs us of the value of the dollars we’ve accumulated over time.

Inflation is a much discussed topic in the financial world and especially when it comes to investing. In theory, we all understand what inflation is and how it affects the value of our dollars.

But in reality, do you know the true rate of inflation? Can you say with surety that your returns are substantial enough to account for inflation and taxation?

The Hidden Tax

When we created the SAO formula we were careful with how we calculated inflation and how we describe its true measure. We even called it the “hidden tax.”

It also affects different investments in different ways. Fixed income investments are highly susceptible to inflation, while real estate cash flows (rents and/or interest payments) rise with it, as does the intrinsic value of real estate.

To understand the true inflation rate, let me point you to an excellent resource: ShadowStats.com

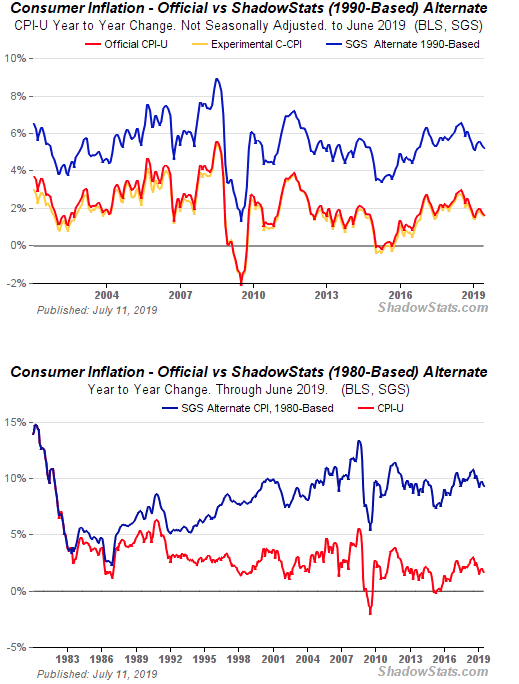

Shadow Stats analyzes government economic reporting to provide “an assessment of underlying economic and financial conditions, net of financial-market and political hype.” In other words, they measure the true rate of inflation — not what the government is reporting. They look at how inflation was calculated over 20 years ago, before the official formula was changed and adapted to serve government interests and image. While the US government reports the official inflation rate at just a bit under 2%, Shadow Stats reports that it is much closer to 6%.

Let’s think. To get that 6% back on investments, you have to earn at least 10% on returns. That 10% includes the combined effect of inflation and taxation. If you have money in savings and you’re not earning at least 10%, you’re losing out to the real inflation rate.

What Does It Have to Do with Investing?

So, yes, inflation is the hidden, silent thief, but there are still smart ways to invest. As we mentioned earlier, inflation affects the kind of assets you invest in.

For example, housing and real estate generally keep up with inflation. As the value of the materials (wood, steel, pipes, etc.) to build increases over time, so does the value of the property. Even if you’re not living in a roller coaster market and are in a more stable market such as Birmingham or Kansas City, your home is normally keeping up with inflation rate.

This is just one of the many reasons to invest in real estate versus other asset classes.

I want to end this post by urging you to be diligent in seeking out returns with consideration to inflation and taxation. As always, do your homework, connect with people who know more than you, and make investment decisions that fit your goals.

When You’re Ready, We’re Here

Interested in learning more about alternative investment opportunities? You’ve come to the right place. Contact us here to find out more!